There are seven federal income tax brackets for 2024. Your tax rate is determined by your income and tax filing status.

Updated May 30, 2024 · 3 min read Written by Sabrina Parys Assistant Assigning Editor Sabrina Parys

Assistant Assigning Editor | Taxes, Investing

Sabrina Parys is an assistant assigning editor on the taxes and investing team at NerdWallet, where she manages and writes content on personal income taxes. Her previous experience includes five years as a copy editor and associate editor in academic and educational publishing. She is based in Brooklyn, New York.

Reviewed by Lei Han Professor of accounting Lei Han

Professor of accounting

Lei Han, Ph.D., is an associate professor of accounting at Niagara University in Western New York and a New York state-licensed CPA. She obtained her Ph.D. in accounting with a minor in finance from the University of Texas at Arlington. Her teaching expertise is advanced accounting and governmental and nonprofit accounting. She is a member of the American Accounting Association and New York State Society of Certified Public Accountants.

At NerdWallet, our content goes through a rigorous editorial review process. We have such confidence in our accurate and useful content that we let outside experts inspect our work.

Assigning Editor Pamela de la Fuente

Assigning Editor | Consumer Credit, Taxes, Retirement, Underrepresented communities, Debt

Pamela de la Fuente leads NerdWallet's consumer credit and debt team. Previously, she led taxes and retirement coverage at NerdWallet. She has been a writer and editor for more than 20 years.

Pamela joined NerdWallet after working at companies including Hallmark Cards, Sprint Corp. and The Kansas City Star.

She is a thought leader in content diversity, equity, inclusion and belonging, and finds ways to make every piece of content conversational and accessible to all.

She is a graduate of the Maynard Institute's Maynard 200 program, and was a presenter at the National Association of Black Journalists convention in 2023. She is a two-time winner of the Kansas City Association of Black Journalists' President's Award. She is also a founding co-chair of NerdWallet's Nerds of Color employee resource group.

Pamela is a firm believer in financial education and closing the generational wealth gap . She got into journalism to tell the kind of stories that change the world, in big and small ways. In her work at NerdWallet, she aims to do just that.

Fact Checked Co-written by Tina Orem Assistant Assigning Editor Tina Orem

Assistant Assigning Editor | Taxes, small business, Social Security and estate planning, home services

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

MORE LIKE THIS Tax brackets and rates TaxesTable of Contents

MORE LIKE THIS Tax brackets and rates TaxesIn 2024, there are seven federal income tax rates and brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Taxable income and filing status determine which federal tax rates apply to you and how much in taxes you'll owe that year.

The federal tax rates will remain the same until 2025 as a result of the Tax Cuts and Jobs Act of 2017. However, the IRS can adjust income thresholds that inform those tax brackets each year to reflect the rate of inflation.

» Ready to crunch the numbers? Estimate your refund or bill with NerdWallet's tax calculator

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Hassle-free tax filing* is $50 for all tax situations — no hidden costs or fees.Maximum refund guaranteed

Get every dollar you deserve* when you file with this tax product, powered by Column Tax. File up to 2x faster than traditional options.* Get your refund, and get on with your life.*guaranteed by Column Tax

There are seven income tax rates for the 2024 tax year, ranging from 10% to 37%. The tax brackets for each filing status, which show how much of someone's taxable income is subject to a particular rate, are up 5.4% from 2023. This could mean lower taxes for those whose income has stayed the same since last year.

The 2024 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

$47,151 to $100,525

$94,301 to $201,050

$47,151 to $100,525

$63,101 to $100,500

$100,526 to $191,950

$201,051 to $383,900

$100,526 to $191,950

$100,501 to $191,950

$191,951 to $243,725

$383,901 to $487,450

$191,951 to $243,725

$191,951 to $243,700

$243,726 to $609,350

$487,451 to $731,200

$243,726 to $365,600

$243,701 to $609,350

Tax brackets 2024: Single filersTaxable income bracket

10% of taxable income.

$1,160 plus 12% of the amount over $11,600.

$47,151 to $100,525.

$5,426 plus 22% of the amount over $47,150.

$100,526 to $191,950.

$17,168.50 plus 24% of the amount over $100,525.

$191,951 to $243,725.

$39,110.50 plus 32% of the amount over $191,950.

$243,726 to $609,350.

$55,678.50 plus 35% of the amount over $243,725.

$183,647.25 plus 37% of the amount over $609,350.

Tax brackets 2024: Married filing jointlyTaxable income bracket

10% of taxable income.

$2,320 plus 12% of the amount over $23,200.

$94,301 to $201,050.

$10,852 plus 22% of the amount over $94,300.

$201,051 to $383,900.

$34,337 plus 24% of the amount over $201,050.

$383,901 to $487,450.

$78,221 plus 32% of the amount over $383,900.

$487,451 to $731,200.

$111,357 plus 35% of the amount over $487,450.

$196,669.50 + 37% of the amount over $731,200.

Tax brackets 2024: Married filing separatelyTaxable income bracket

10% of taxable income.

$1,160 plus 12% of the amount over $11,600.

$47,151 to $100,525.

$5,426 plus 22% of the amount over $47,150.

$100,526 to $191,950.

$17,168.50 plus 24% of the amount over $100,525.

$191,951 to $243,725.

$39,110.50 plus 32% of the amount over $191,950.

$243,726 to $365,600

$55,678.50 plus 35% of the amount over $243,725.

$98,334.75 plus 37% of the amount over $365,600.

Tax brackets 2024: Head of householdTaxable income bracket

10% of taxable income.

$1,655 plus 12% of the amount over $16,500.

$63,101 to $100,500.

$7,241 plus 22% of the amount over $63,100.

$100,501 to $191,950.

$15,469 plus 24% of the amount over $100,500.

$191,951 to $243,700.

$37,417 plus 32% of the amount over $191,950.

$243,701 to $609,350.

$53,977 plus 35% of the amount over $243,700.

$181,954.50 plus 37% of the amount over $609,350.

The tax tables below show the rates and brackets that apply to income earned in 2023. Tax returns for 2023 were due on April 15, 2024, for most filers. If you secured an extension by tax day, your new federal filing deadline is Oct. 15, 2024, but if you have a tax bill, that should be paid as soon as possible to reduce penalties and interest.

$89,451 to $190,750

$95,376 to $182,100

$190,751 to $364,200

$95,376 to $182,100

$95,351 to $182,100

$182,101 to $231,250

$364,201 to $462,500

$182,101 to $231,250

$182,101 to $231,250

$231,251 to $578,125

$462,501 to $693,750

$231,251 to $346,875

$231,251 to $578,100

Tax brackets 2023: Single filersTaxable income bracket

10% of taxable income.

$1,100 plus 12% of the amount over $11,000.

$5,147 plus 22% of the amount over $44,725.

$95,376 to $182,100.

$16,290 plus 24% of the amount over $95,375.

$182,101 to $231,250.

$37,104 plus 32% of the amount over $182,100.

$231,251 to $578,125.

$52,832 plus 35% of the amount over $231,250.

$174,238.25 plus 37% of the amount over $578,125.

Tax brackets 2023: Married filing jointlyTaxable income bracket

10% of taxable income.

$2,200 plus 12% of the amount over $22,000.

$89,451 to $190,750.

$10,294 plus 22% of the amount over $89,450.

$190,751 to $364,200.

$32,580 plus 24% of the amount over $190,750.

$364,201 to $462,500.

$74,208 plus 32% of the amount over $364,200.

$462,501 to $693,750.

$105,664 plus 35% of the amount over $462,500.

$186,601.50 + 37% of the amount over $693,750.

Tax brackets 2023: Married filing separatelyTaxable income bracket

10% of taxable income.

$1,100 plus 12% of the amount over $11,000.

$5,147 plus 22% of the amount over $44,725.

$95,376 to $182,100.

$16,290 plus 24% of the amount over $95,375.

$182,101 to $231,250.

$37,104 plus 32% of the amount over $182,100.

$231,251 to $346,875.

$52,832 plus 35% of the amount over $231,250.

$93,300.75 plus 37% of the amount over $346,875.

Tax brackets 2023: Head of householdTaxable income bracket

10% of taxable income.

$1,570 plus 12% of the amount over $15,700.

$6,868 plus 22% of the amount over $59,850.

$95,351 to $182,100.

$14,678 plus 24% of the amount over $95,350.

$182,101 to $231,250.

$35,498 plus 32% of the amount over $182,100.

$231,251 to $578,100.

$51,226 plus 35% of the amount over $231,250.

$172,623.50 plus 37% of the amount over $578,100.

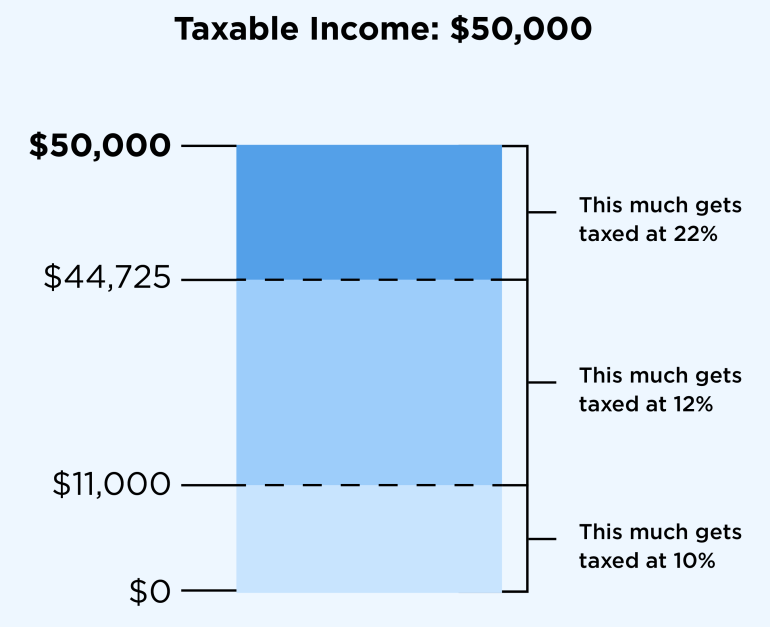

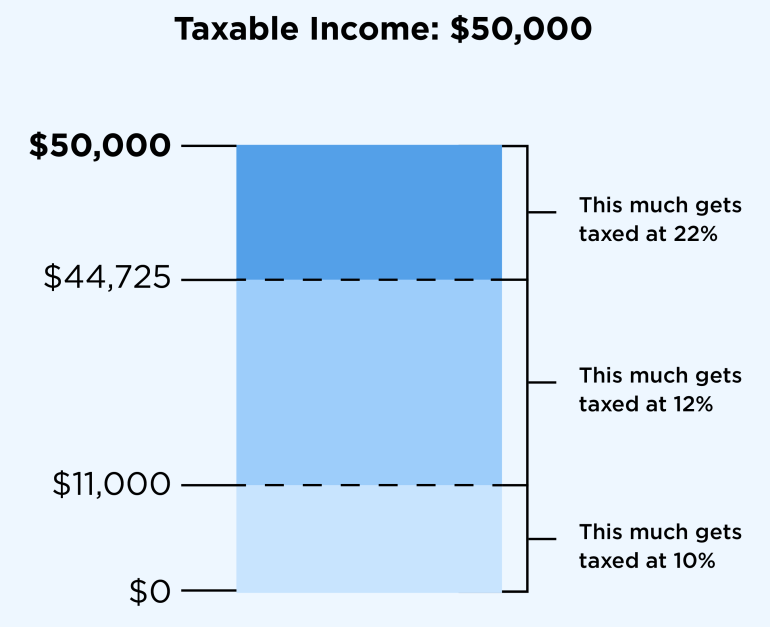

The U.S. has a progressive tax system, which means that people with higher incomes are subject to higher federal tax rates, and people with lower incomes are subject to lower income tax rates.

The government decides how much tax you owe by dividing your taxable income into chunks — also known as tax brackets — and each individual chunk gets taxed at a corresponding tax rate. Tax rates can range from 10% to 37%.

The beauty of tax brackets is that no matter which bracket(s) you’re in, you generally won’t pay that tax rate on your entire income. The highest tax rate you pay applies to only a portion of your income.

Federal tax brackets example: If you had $50,000 of taxable income in 2023 as a single filer, you’d pay 10% on that first $11,000 and 12% on the chunk of income between $11,001 and $44,725. Then you’d pay 22% on the rest because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,300 — about 13% of your taxable income — even though your highest bracket is 22%. That 13% is your effective tax rate .

States may handle taxes differently than the federal government. Your state might have different brackets, or it might altogether use a different system. Colorado, for example, has a flat tax rate of 4.4% on taxable income, and some states, such as Wyoming, don't have a state income tax.

Each year, all the federal income tax brackets — the window of income where a certain tax rate ends and begins — are updated to reflect the current rate of inflation. These tweaks, formally known as inflation adjustments, are a critical part of the tax code.

Bracket adjustments can help prevent taxpayers from ending up in a higher tax bracket as their cost of living rises, a scenario called “bracket creep." They can also lower taxes for those whose compensation has not kept up with inflation.

Tax inflation adjustment example

In 2023, a single filer making $45,000 of taxable income pays a 10% tax rate on $11,000 of their earnings, a 12% tax rate on the portion of the earnings between $11,001 and $44,725, and a 22% tax rate on the remaining $275 that falls into that final tax bracket.

Assuming this taxpayer's income does not change in 2024, they will now pay 10% on earnings up to $11,600 and 12% on the rest. In other words, they will no longer pay 22% on any part of their income. This is because the upper end of the 12% tax bracket has been updated from $44,725 to $47,150, which allows this taxpayer to shelter more of their income from a higher tax rate.

The marginal tax rate is the tax rate paid on the last dollar of taxable income. It typically equates to your highest tax bracket.

For example, if you're a single filer in 2023 with $35,000 of taxable income, portions of your income would be taxed at 10% and 12%. If your taxable income went up by $1, you would pay 12% on that extra dollar, too.

Your effective tax rate is the percentage of your taxable income that you pay in taxes. To determine your effective tax rate, divide your total tax owed (line 24) on Form 1040 by your total taxable income (line 15).

Two common ways of reducing your tax bill are credits and deductions.

Tax credits can reduce your tax bill on a dollar-for-dollar basis; they don't affect what bracket you're in.

Tax deductions , on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So, if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words, take all the tax deductions you can claim. Deductions can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Learn MoreYou’re following Sabrina Parys

Visit your My NerdWallet Settings page to see all the writers you're following.

Sabrina Parys is a content management specialist on the taxes and investing team at NerdWallet, where she manages and writes content on personal income taxes. Her work has appeared in The Associated Press, The Washington Post and Yahoo Finance. See full bio.

You’re following Tina Orem

Visit your My NerdWallet Settings page to see all the writers you're following.

Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105